Austin’s real estate landscape offers a unique mix of opportunities and challenges, with housing prices stabilizing and tech-sector growth fueling demand. Here’s how it shapes up this fall.

Considering Austin was created to help families find a financially sustainable lifestyle in Texas. Whether you're tired of working hard but not getting ahead or just want a better quality of life, the Greater Austin Metropolitan Area continues to offer opportunities.

We are often asked three questions:

- How is the real estate market?

- Are people still moving to Austin?

- How is the job market in Austin?

In this update, we’ll dive into the latest data to answer those questions, explore current trends, and talk about why Austin and the Texas Triangle (Dallas, Fort Worth, Austin, San Antonio, and Houston) are looking ahead to a bright future.

Our market updates always have one central theme and this season it is affordability. While you are reading this, keep in mind, like most things, it is all relative. If Austin home prices are half of other metro areas, it makes Austin’s market look even more affordable.

Let’s unpack the affordability problem:

- Lack of affordable housing is real and nationwide – some areas are worse than others!

- What would have to happen to resolve it?

- Relocation to more affordable areas may be the best solution.

The good news is, people are taking advantage of Austin’s relatively lower prices to dramatically improve their financial situation – just like we did.

Affordability: What’s Really Going On?

Let’s be honest: affordability is on everyone’s mind. Whether it’s about buying a home, groceries, or even insurance, everything just seems more expensive. Inflation, driven by excess government spending is affecting families all over the country, including those who live in cities like Austin.

Why Are Houses So Unaffordable?

There are five main factors that drive home affordability:

- House Prices

- Mortgage Interest Rates

- Debt Levels

- Income and Job Stability

- Property Taxes & Insurance

In this update, we’ll focus on the first four, but just know: homeowners insurance is quickly becoming a major pain point for buyers, especially in California and Florida.

House Prices: The Texas Tale

Here’s good news for those who are moving to Austin: Texas is one of the few states seeing a slight dip in home prices. Over the last 12 months, Texas has seen a 0.2% decrease in house prices, while Travis County (where Austin is located) saw a drop of 2.9% as shown in the following charts.

Home Value Growth YoY % (year over year percentage change) for the U.S.

Why is this good news for those thinking of relocating from high-cost, high-tax states and cities? Because, when you sell high, and buy low, or buy low and sell high, that is a recipe for financial success. That is how wealth is built.

Consider the surging prices in Coastal California, Chicago, and New York, where prices continue to rise by 4.3% to 6.7% as shown in the map above. The gap between unaffordable (those states) and more affordable (Texas) gets bigger, which means Greater Austin becomes a better value (arbitrage). In simple terms, Austin housing affordability is better than many other metro areas.

Below are two charts that illustrate the affordability challenge. The first shows Home Values Across U.S. States as of July 2024. Specifically, the chart/map shows typical mid-priced home values by state.

Using the numbers in the chart above, we can calculate how much more expensive high-tax states are compared to Texas:

- California: 155%

- Washington: 95%

- Colorado: 79%

- New Jersey: 75%

- New York: 57%

Here’s another way to look at it. A house that costs $500,000 in Texas would cost:

- California: $1,278,501

- Washington: $978,827

- Colorado: $897,394

- New Jersey: $876,221

- New York: $788,273

The graphic below 'Housing Affordability Across U.S. States' tells a similar story about relative affordability (one state versus another), however, the bigger conclusion is that housing is not affordable anywhere. In the 1990s, affordability hovered around 30-40% and in 2010 it was above 50%.

California vs. Texas: The Affordability Gap

Take a look at what the chart below is showing: it takes nine years of income to buy a house in California. If annual personal income is 11% of the home price, that means it would take 100/11 = 9 years. In Texas, it takes about 4-1/2 years, i.e., 100/22 = 4.5.

This is a huge gap and one of the reasons why families are starting to look toward Austin as a serious option. Remember: Austin has the perks of a cosmopolitan city while maintaining its small-town charm. That’s why people are drawn here—and it’s why they’re staying.

After house prices, the next most important thing is mortgage rates—more specifically, mortgage payments that are a function of rates.

Mortgage Rates: What’s the Deal?

We all know mortgage rates have been rising, and they're making it tougher for buyers. Rates have more than doubled over the past three years, with 30-year fixed rates now above 7% for those with high credit scores. Look at the following chart that shows mortgage rates from early October 2022 to October 17th, 2024.

Notice, on the chart below, how in the past three years, even with rates coming down, mortgage rates are still more than 2x what they used to be. The low point on that small dip on the right was the day before the Fed cut rates. Wait, what?

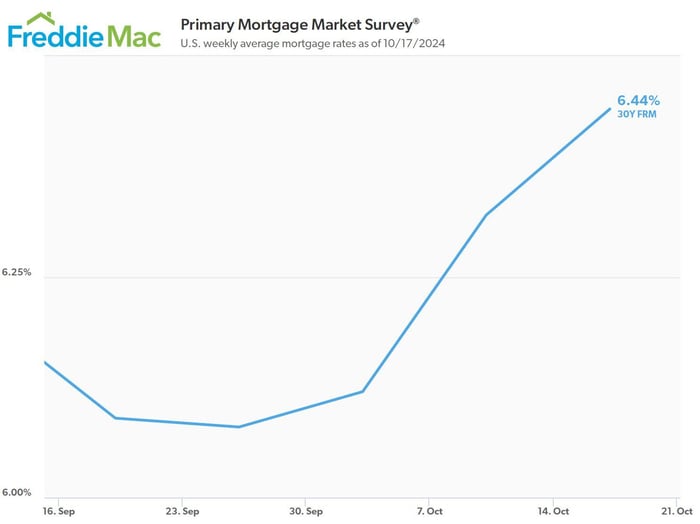

Below is a better look: a one-month chart showing how mortgage rates have gone up since the Fed cut rates (50 bps or 1/2%) on September 19th.

How can mortgage rates go up right after the Fed cuts rates? The answer is that the Federal Reserve controls the federal funds rate, which affects short-term interest rates. The fed funds rate is an overnight interest rate.

Mortgages are more closely tied to long-term bond yields, which the Fed does not control. The bond market is affected by inflation and credit risk concerns. Inflation has picked up recently and many are concerned that the U.S. is adding $1 trillion to the national debt every 100 days.

But don’t lose hope! If you're able to lock in a rate sooner rather than later, you might avoid further rate increases—and builders are offering some great incentives right now, including below-market interest rates on new homes. This could make buying new construction a more affordable option than a resale home.

Consider the difference in mortgage payments, for a similar house, in different states. For this example, we will not include property taxes, HOA dues, or homeowners insurance. Even people who own their homes free-and-clear (mortgage paid off) are becoming concerned about the cost of insurance.

The table below shows Texas housing market trends, i.e., equivalent home prices in other states. And I’ve added columns showing example mortgage payments and the amount of money that would have to be saved for a 6-month emergency account in other states like NY, NJ, CO, WA, and CA. The numbers below do not include property taxes, homeowners insurance, and/or HOA dues. This shows just the principal and interest on a 30-yr fixed rate mortgage.

Notice that what would cost $500,000 in the Austin area could cost $788,273 in New York or $1,278,000 in California.

Our goal is to help people live their best version of life while staying on a financially sustainable trajectory. That means having enough money left over each month to maintain an emergency account (6 months of reserves), save for retirement, and take family vacations.

Because life happens to all of us, it’s not just about affording the monthly payment. Equally important is having enough in savings so you don’t lose the house if you go through a rough period. For those who live in high-tax states, it is doubly difficult to build and maintain an adequate emergency fund.

Case in point, since wages are often very similar between Austin and high-cost states, looking at those mortgage payments above, imagine how much harder it would be to build a 6-month emergency fund if your principal and interest mortgage payment was $6,765 (CA) vs. $2,645 (TX).

How Can Affordability Be Fixed?

Let’s say someone lives in a high-cost area but they have a low fixed-rate mortgage; does it make sense for them to sell and move? In the absence of all other considerations, perhaps not. But relocating is never a one-dimensional question. This is why we’ve created a unique six-step process to take everything into account, including and especially things people may not have thought to consider.

What will it take for housing affordability to return to its previous levels. I’ve shown this chart before but it’s worth repeating.

To get housing prices back to pre-COVID levels, one (or a combination of these things) needs to happen:

- Average person makes 69% more income

- Average house price becomes 41% cheaper

- Average mortgage rate drops by 4%

Ideally, it would be a combination of these: income goes up 10%, housing prices come down 10%, and rates come down 2%. That would be a softer landing. The real issue is that workers’ incomes are not going up 69%. And is there any way for house prices to come down, and/or rates to drop without a recession?

Austin Mortgage Rates and Interest Rate Trends

No one knows what rates will be next month or next year. We help our clients actively manage their mortgage, which means we track their mortgage rate and when possible, we refinance their loan (often at no cost, via a lender credit) so they minimize interest paid over their lifetime.

Choosing a city and house that is well within your means allows you to build wealth and weather storms. If and when mortgage rates come down, refinancing is an easy project. That is something we’ve been helping people optimize for over two decades.

Getting into a lower cost house is much more important than trying to time the mortgage market. Let’s look at Austin’s housing market.

Austin Real Estate Market Trends in 2024

Below is a table that summarizes what is happening with housing in Austin Metro Area real estate. This area is sometimes referred to as Austin Round Rock MSA. It includes Travis County and Williamson County and, as you can see in the population totals below, that is where most people live. Austin is in Travis County and the other five counties are where substantial growth is occurring.

Specifically, this table shows year-over-year (YoY) percentage changes in median prices, active listings, number of homes sold, and Austin housing inventory trends.

What you notice is that median prices have dropped a bit in the last twelve months, active listings are mostly up, and except for Travis County, inventory is very low. The number of homes for sale in Travis County has increased by 14%, and Williamson County inventory is up by 10% year-over-year. This points to better Austin housing affordability because buyers more options to choose from.

For those considering new construction, it’s a great time to shop. Builders have more standing inventory than they’ve had in years, and many are throwing in extras like rate buydowns and incentives that traditional sellers can’t match. This is especially true in some of the best neighborhoods in Greater Austin, including Georgetown, Cedar Park, Leander, and other fast-growing neighborhoods.

Now Is A Good Time to Buy

While it is difficult to get numbers, anecdotal evidence suggests new home builders have more standing inventory than they have for a long time. This makes it a great time to consider new homes because existing home sellers cannot compete with builder incentives like below market interest rates, etc.

Regarding the current resale housing market and the lock-in effect of those with mortgage rates below three percent, John Downs (@AdvisorJohn on X) succinctly summarized that group as follows.

“I believe housing will stay locked up longer than expected. From 2012-2022, moving was easy—plenty of equity, quick sales, and affordable rates. Today, it's much harder and more expensive, with uncertainty around selling and significant payment shock.

The mortgage and real estate industry should accept 2024 volumes as the new normal. Downsizers are realizing that it doesn't save them enough to justify the move. It’s similar to the post-housing crisis, but now, instead of lacking equity, people have it—it's just the new payments that are too high.”

Many people who move from expensive areas to less expensive areas like Austin can pay cash so John's summary above would not apply.

Job Market - Why Austin Retains Its Appeal

Even with rising interest rates, one thing hasn’t changed: people are still moving to Austin. Texas continues to lead the nation in job growth, adding over 327,400 jobs in the past year alone. The tech sector is booming with companies like Tesla, Apple, and Oracle all expanding their presence here.

In fact, Tesla, which is Austin’s second largest employer, just announced they are planning to increase the size of their Giga Factory in Austin by an additional 5 million square feet. That factory, by the way, is already larger than the Pentagon and Apple’s new headquarters in Cupertino, CA combined.

Texas remains a top state for job creation, adding over 2.4 million jobs since 2015. With 29,200 new jobs in September alone, Texas continues to provide opportunities for families and entrepreneurs alike.

For families considering relocation, job security is always a major factor, and Austin’s job market remains one of its strongest selling points.

Check out this amazing YouTube video called: Why Texas is Becoming The Most Powerful State. It highlights the state's unmatched growth trajectory, from booming job opportunities to a low-tax environment. If the video won't load within your browser, click here.

For families considering Austin, the video provides a great look at how the state’s economic strengths translate to a financially sustainable lifestyle. Another hint at how robust the Austin Metro economy is can be seen in airport traffic. Much of that traffic is related to tourism, which accounted for over $8.2 billion in 2022.

Austin International Airport Is Booming

According to KXAN News - after two record-setting years in a row, 2024 is likely to be another incredibly busy year at Austin-Bergstrom International Airport. Last year saw a little more than 22 million passengers fly in and out of AUS, more than 1 million more than the previous record, set in 2022.

Austin Continues to Grow

Look at these two pictures of Austin, one from 2014 and the second one from 2024, courtesy Katherine Harrison on the Austin Memories Facebook group page.

Courtesy, Facebook Group: Austin Memories, Katherine Harrison

Who would have imagined this type of growth? And a week doesn’t go by without the Austin Business Journal talking about some new high rise and community coming soon. Be sure to check out our Spring 2024 Downtown Austin Update.

The connection between Austin job growth and its housing market cannot be overstated. Companies need skilled workers. Those workers want to own houses in safe neighborhoods but they don’t want to be house poor like their friends who live in high-cost, high-tax states.

When you compare Texas vs. California home prices, like we did above, it is easy to see why people are attracted to Austin. It offers a great cosmopolitan experience, as both the live music and foodie capital of the U.S., as well as affordable, safe suburban neighborhoods.

Austin: A Top Choice for Relocation in 2024

If you are seeking a lower-cost, high-opportunity environment like Austin offers, and as long as house prices in Texas are 40% - 255% cheaper than other major markets, and so long as Texas job growth leads the nation, Greater Austin has a very bright future.

Tech companies like Tesla, Apple, Amazon, Oracle, Firefly, and others continue to expand and hire. Those high-paying jobs attract every imaginable service business to support the growth.

Earlier this year, we profiled Lockhart, one of many affordable places to live near Austin. It is a great small community, south of downtown, where first-time homebuyers can affordably get their start on the American dream.

Where else besides the Austin Metro Area can people buy beautiful homes, on acreage or a golf course, and still be within 30 minutes of where their kids and grandkids can afford to buy and own?

Austin continues to balance growth, affordability, and opportunity better than many cities in the U.S. Yes, the market has its challenges (affordability, mortgage rates), but when compared to other major markets, it’s clear: Austin is still a top choice for families looking for a better quality of life.

Next Steps

Moving to Austin from high-cost states is the opportunity if you’re ready. Whether it’s considering a newly built house, with great incentives, or making a strategic move before prices bounce back, now is a good time to take a deeper look. And that’s our specialty, helping people consider all aspects of relocating or moving to another city like Austin, Texas.

If you’re wondering how to make the most of the Austin market, or just want to learn more, we’d love to chat. Contact us to see how Austin’s market can benefit your lifestyle and financial goals

Final Thoughts

There’s no denying that uncertainty is part of today’s market. But as John Allen Paulos said, "Uncertainty is the only certainty there is, and knowing how to live with insecurity is the only security." The good news?

We can help you navigate that uncertainty and find the home and the lifestyle you’ve been working hard for.

Resources:

- Two million bats swarm over bridge in Austin, Texas: https://youtu.be/v21h7cZ16QU?si=p7O4oJUJUGXJ2EdK

- https://reventureconsulting.com/

- https://www.census.gov/data/tables/time-series/demo/popest/2020s-total-metro-and-micro-statistical-areas.html

- https://www.newyorkfed.org/microeconomics/hhdc

- https://www.voronoiapp.com/real-estate/-Housing-Affordability-Across-US-States-2024-2049

- https://www.voronoiapp.com/real-estate/-Home-Values-Across-US-States-July-2024-2160

- https://www.highway.ai/blog/october-15-2024-mortgage-market-news

- https://www.resiclubanalytics.com/p/the-affordability-strained-housing-market-as-told-by-one-chart

- https://www.kut.org/austin/2024-03-19/austin-population-census-data-net-migration

- https://www.citypopulation.de/en/usa/metro/12420__austin_round_rock_geo/

- https://zillow.com/research/data/

- https://www.realtor.com/research/data/

- https://wwwredfin.com/county/2666/TX/Burnet-County/housing-market

- https://abor.com/marketstatistics

- https://fred.stlouisfed.org/series/FIXHAI

- https://www.cnbc.com/2024/08/06/new-york-fed-credit-card-debt-hits-record-1point14-trillion.html

- https://www.borrowsmartuniversity.com/blog

- https://www.consideringaustin.com/austin-favorites/new-affordable-homes-near-austin-tx

- https://atxtoday.6amcity.com/biz/austin-festivals-economic-impact

- https://www.freddiemac.com/pmms

- https://gov.texas.gov/news/post/texas-outperforms-u.s-in-annual-job-growth-rate

- https://www.corelogic.com/intelligence/homeowner-equity-insights-q1-2023/

- https://www.kxan.com/news/local/austin/passenger-growth-at-austins-airport-is-hitting-forecasts-five-years-ahead-of-schedule/

- https://www.facebook.com/groups/357859074303435/

.png?width=161&height=74&name=considering%20AUSTIN%20(1).png)